fujikura-sale.ru

Gainers & Losers

Portfolio Mgt

A portfolio manager (PM) is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested. Portfolio management refers to the centralized management of one or more portfolios, which includes identifying, prioritizing, authorizing, managing, and. This reading provides an overview of portfolio management and the asset managementindustry, including types of investors and investment plans and products. A. Delta Capital Management manages assets under four primary portfolio shells. The following are a list of the types and a brief description of their. Portfolio management involves selecting and overseeing a group of investments that meet a client's long-term financial objectives and risk tolerance. Project portfolio management, or PPM, is a top-down process. A group of decision-makers in an organization, led by a portfolio manager, examines each potential. Portfolio management is the process of creating and managing your investment account. And when you start investing, one of your first decisions is choosing. Free portfolio manager tool from Morningstar. Track all of your equity, fund, investment trust, ETF and pension investments quickly and simply in one place. Portfolio managers are investment decision-makers. They devise and implement investment strategies and processes to meet client goals and constraints. A portfolio manager (PM) is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested. Portfolio management refers to the centralized management of one or more portfolios, which includes identifying, prioritizing, authorizing, managing, and. This reading provides an overview of portfolio management and the asset managementindustry, including types of investors and investment plans and products. A. Delta Capital Management manages assets under four primary portfolio shells. The following are a list of the types and a brief description of their. Portfolio management involves selecting and overseeing a group of investments that meet a client's long-term financial objectives and risk tolerance. Project portfolio management, or PPM, is a top-down process. A group of decision-makers in an organization, led by a portfolio manager, examines each potential. Portfolio management is the process of creating and managing your investment account. And when you start investing, one of your first decisions is choosing. Free portfolio manager tool from Morningstar. Track all of your equity, fund, investment trust, ETF and pension investments quickly and simply in one place. Portfolio managers are investment decision-makers. They devise and implement investment strategies and processes to meet client goals and constraints.

IT portfolio management focuses solely on the IT department's projects and teams. IT portfolio managers assess IT projects for their growth potential. Helping you track and improve energy efficiency across your entire portfolio of properties. Username: *. Password. The continuing education (CE) course "Portfolio Management Compliance" covers the topics that prospective discretionary portfolio managers must be familiar. PMT® delivers a deeper understanding of advanced portfolio management techniques suitable for high-net-worth clients and institutional investors. A portfolio manager is responsible for investing a fund's assets, implementing its investment strategy, and managing the day-to-day portfolio trading. Portfolio management is the selection, prioritisation and control of an organisation's programmes and projects, in line with its strategic objectives and. Project portfolio management sets out a methodology used to predict potential problems, review progress towards operational goals, manage budgets, and address. Project portfolio management requires a balance of resources, time, skills, budgets, risk mitigation and running the projects in the portfolio frugally and. A portfolio in project management refers to a grouping of projects, and programs. It can also include other project-related activities and responsibilities. The. Our asset and portfolio management services help you reach your long-term financial goals and build a more secure future. Learn about diversification, asset allocation, rebalancing, risk, and other aspects of portfolio management. The Portfolio Management Professional (PfMP)® certification helps advance experience and skills of portfolio managers. Take the next step here! Portfolio Management and Risk Analytics in Charles River Charles River Investment Management Solution (Charles River IMS) provides firms with a complete. IT portfolio management IT portfolio management is the application of systematic management to the investments, projects and activities of enterprise. What Does a Portfolio Manager Do? – The Six-Step Portfolio Management Process · #1 Determine the Client's Objective · #2 Choose the Optimal Asset Classes · #3. Portfolio Management. Portfolio management ensures that an organization can leverage its project selection and execution success. It refers to the centralized. What is Portfolio Management? Portfolio management's meaning can be explained as the process of managing individuals' investments so that they maximise their. WHAT IS THE MINIMUM INVESTMENT? Our Private Portfolio Management service is available to individuals, families, holding companies, trusts, estates, and. With the ServiceNow® Portfolio Management application, you can create portfolios which are collections of related programs, projects, and demands. Active Portfolio Management: A Quantitative Approach for Producing Superior Returns and Controlling Risk [Grinold, Richard C., Kahn, Ronald N.] on.

Where Can I Find The Square Footage Of My House

To calculate square footage, all of your measurements need to be in feet. If you recorded the length and width in inches, you can easily convert them to feet. How to calculate the square footage of a house · Create a floor plan: Draw out a floor plan of each level of your house. · Measure individual rooms: Measure the. The county or city building department, or possibly the Assessor's office, has the square footage of every house on record. You just multiply the length of a room or house in feet by the width in feet. You shouldn't necessarily include every space in your home in your square. For detached properties, it is common to measure the perimeter of the house but to only include the living areas, not porches, patios or garages. Gross living. For rectangular homes, you can just take the area of the building. A one-story ranch measuring 50 feet by 40 feet would therefore have square footage of 2, To calculate the square footage of a home, measure the length and width of each room and multiply to find the square footage of each room. Then, add the square. Areas to Include When Calculating Square Footage - There are specific areas to include when calculating square footage in your home. The Square Footage Calculator estimates the square footage of a lot, house, or other surfaces in several common shapes. If the surface is complex in shape, it. To calculate square footage, all of your measurements need to be in feet. If you recorded the length and width in inches, you can easily convert them to feet. How to calculate the square footage of a house · Create a floor plan: Draw out a floor plan of each level of your house. · Measure individual rooms: Measure the. The county or city building department, or possibly the Assessor's office, has the square footage of every house on record. You just multiply the length of a room or house in feet by the width in feet. You shouldn't necessarily include every space in your home in your square. For detached properties, it is common to measure the perimeter of the house but to only include the living areas, not porches, patios or garages. Gross living. For rectangular homes, you can just take the area of the building. A one-story ranch measuring 50 feet by 40 feet would therefore have square footage of 2, To calculate the square footage of a home, measure the length and width of each room and multiply to find the square footage of each room. Then, add the square. Areas to Include When Calculating Square Footage - There are specific areas to include when calculating square footage in your home. The Square Footage Calculator estimates the square footage of a lot, house, or other surfaces in several common shapes. If the surface is complex in shape, it.

You just multiply the length of a room or house in feet by the width in feet. You shouldn't necessarily include every space in your home in your square. Square footage is the total space in a building. It's calculated by multiplying the length of a structure by its width. New York City real estate is expensive. 3. How can I find out the square footage of my home and when it was built? Information regarding a property's square footage and the year the property was built. Square footage is the total space in a building. It's calculated by multiplying the length of a structure by its width. New York City real estate is expensive. It sounds like you are asking about exterior steps to an entry to a house. From my experience in Washington State, USA, when buying a home, the. If you're selling a home in Flower Mound, Frisco, or any other city in North Texas you may not be sure of your home's square footage, or if what's in your. For example, a 18'x30′ section (18 feet width, 30 feet depth) would have a total area of sq ft. Now repeat this process for every section of the house that. Put simply, square footage is the measurement of a surface area in square feet. This measurement is typically used to determine the size of a property and is. Thankfully, figuring out your square footage is incredibly easy! To measure the square footage of a room, you must first find the square footage of all areas of. There is a cost for every area of your home, so shouldn't every square foot be accounted for? home's square footage calculation to estimate the total value of. Multiply the length by the width and there you go! You have the square footage. Let's say a room is 20 feet long and 20 feet wide, then 20 x 20 = square. To calculate room square footage, first measure the dimensions of your space. The two dimensions to measure are the length and width of the area you need to. Finished vs. Unfinished Areas of Your Home In some cases, you might see square footage in two categories — finished and unfinished. The finished square. If there's a part of your house that's shaped like a half of a circle, you can find the square footage of the circle by finding the area of the space as if it. MEASURING A HOUSE, WHAT COUNTS? Not all of the space under your roof counts as living space from an appraiser's perspective. Some spaces don't count towards. It will often be described as, the house has 2, finished square feet, or the master bedroom is square feet. In a square or rectangle area, the square. Measurements should be taken from the exterior of the house. 2. Square footage should include heated, finished areas only. 3. Enclosed porches, breezeways. If there's a part of your house that's shaped like a half of a circle, you can find the square footage of the circle by finding the area of the space as if it. Only space above grade or above ground can be used to calculate the square footage. If you have finished basement space and it is completely underground or. If the shape of your room is irregular, then it would be best to divide the area into smaller shapes and add up the individual areas. How to Use This Calculator.

How To Pay Charge Off

What Happens If a Charge-off Appears on My Credit Report? While the creditor considers the debt uncollectible, you are still obligated to pay it. · Federal. The same goes for principal balance: the lender can charge-off the entire principal balance or only a portion. charge-offs are logged in LMS as a payment or a. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. Some experts state emphatically that you still owe an old debt, even if it's been charged off. The charge-off, they note, is mainly for the creditor's benefit. Settling a charged-off debt means that you negotiate with the creditor to pay a portion of the outstanding balance, and they agree to forgive. Pay for Delete: Some creditors might be willing to remove the charge-off from your credit report if you pay the outstanding debt. · Negotiate a Settlement. Settling a charge-off debt means negotiating with the creditor to pay less than the full amount you owe. This is usually done as a lump-sum payment, although. The only way to remove a charge-off from your credit report without paying is to wait until it expires from your credit reports. After seven years, a charge-off. A charge-off refers to when a creditor determines an account is too overdue (delinquent) to continue attempting to collect the debt. Most creditors will only. What Happens If a Charge-off Appears on My Credit Report? While the creditor considers the debt uncollectible, you are still obligated to pay it. · Federal. The same goes for principal balance: the lender can charge-off the entire principal balance or only a portion. charge-offs are logged in LMS as a payment or a. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. Some experts state emphatically that you still owe an old debt, even if it's been charged off. The charge-off, they note, is mainly for the creditor's benefit. Settling a charged-off debt means that you negotiate with the creditor to pay a portion of the outstanding balance, and they agree to forgive. Pay for Delete: Some creditors might be willing to remove the charge-off from your credit report if you pay the outstanding debt. · Negotiate a Settlement. Settling a charge-off debt means negotiating with the creditor to pay less than the full amount you owe. This is usually done as a lump-sum payment, although. The only way to remove a charge-off from your credit report without paying is to wait until it expires from your credit reports. After seven years, a charge-off. A charge-off refers to when a creditor determines an account is too overdue (delinquent) to continue attempting to collect the debt. Most creditors will only.

This article explains why it's important to pay off your credit card debt every month for financial stability. You can negotiate a settlement to a credit card debt before the credit card issuer moves the debt to a charge-off status. If your debt has been charged off, you do owe the balance and there can be serious consequences if it goes unpaid, such as a frozen bank account or wage. In the event your debt is charged off, as long as there is a balance, you're still responsible for repayment which is why you should consider ways to pay off. Settling a charged-off debt means that you negotiate with the creditor to pay a portion of the outstanding balance, and they agree to forgive. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. The only way to remove a charge-off from your credit report without paying is to wait until it expires from your credit reports. After seven years, a charge-off. How to Avoid a Charge-Off The only way to avoid a charge-off is by getting help before it's too late - before the account actually charges off. It may seem. Some credit counseling organizations charge high fees, which they might not tell you about. A reputable credit counseling organization should send you free. For manually underwritten loans, non-medical collection accounts and charge-offs on non-mortgage accounts do not have to be paid off at or prior to closing if. These amounts are reported to credit reporting agencies. It may appear on credit reports, as charged-off debt is still owed. A creditor may still look to. Affirm never charges late fees, but if you've stopped making payments for more than days, we may charge off your loan. My loan was charged off. So why is the bank still requiring payment? When a bank charges off a loan, it is an accounting procedure. It does not eliminate your. How to Avoid a Charge-Off The only way to avoid a charge-off is by getting help before it's too late - before the account actually charges off. It may seem. Note that in both circumstances, the debt is not forgiven. You are still responsible for paying off your debts, unless you've received a discharge in bankruptcy. If your debt is still with the original lender, you can ask to pay the debt in full in exchange for the charge-off notation to be removed from your credit. An uncollectable account that has been charged off as bad debt will haunt your credit history for a long time, so it's best to pay off your balance even after. A borrower is still obligated to repay the debt they owe on an account after a lender has charged it off. The borrower continues to owe this debt until they pay. It may also be wise to contact the lender to discuss a payment settlement, which may also reduce the credit impact. If a credit card account is charged off, it. This occurs when a consumer becomes severely delinquent on a debt. Traditionally, creditors make this declaration at the point of six months without payment. A.

Gas With Credit Card

You may be able to manage it by going into the station and having the clerk manually enter the numbers after after they look over the card and attempt to swipe. Sheetz Fleet fuel loyalty card. Credit card exclusively for use at Sheetz locations. checked icon. Save up to 6¢/gas · Fill up at over Sheetz locations. Using credit rather than debit to get gas provides more fraud protection. It could also get you cash back rewards—and, sometimes, even free gas. Fleet fuel cards from Fuel Express look like a debit or credit card. However, they operate quite differently. Their goal is to make it easier to manage a fleet. When you get to the gas station, get out and swipe/tap/insert your card at the pump. The screen may prompt you. Using the right credit card on your Gas Stations purchases can maximize your rewards. Here are the top 3 credit cards for Gas Stations. Earn rewards like cash back and points every time you fuel up at the gas station with your credit card. Explore Mastercard credit cards to find the right. The best gas credit card in Canada will get you major returns every time you're forced to fill up your car. Make sure you're making the most of every dollar. Many people reach for a debit card or cash when filling up on gas, but there are several key advantages to using a credit card at the pump. You may be able to manage it by going into the station and having the clerk manually enter the numbers after after they look over the card and attempt to swipe. Sheetz Fleet fuel loyalty card. Credit card exclusively for use at Sheetz locations. checked icon. Save up to 6¢/gas · Fill up at over Sheetz locations. Using credit rather than debit to get gas provides more fraud protection. It could also get you cash back rewards—and, sometimes, even free gas. Fleet fuel cards from Fuel Express look like a debit or credit card. However, they operate quite differently. Their goal is to make it easier to manage a fleet. When you get to the gas station, get out and swipe/tap/insert your card at the pump. The screen may prompt you. Using the right credit card on your Gas Stations purchases can maximize your rewards. Here are the top 3 credit cards for Gas Stations. Earn rewards like cash back and points every time you fuel up at the gas station with your credit card. Explore Mastercard credit cards to find the right. The best gas credit card in Canada will get you major returns every time you're forced to fill up your car. Make sure you're making the most of every dollar. Many people reach for a debit card or cash when filling up on gas, but there are several key advantages to using a credit card at the pump.

Pay at the pump is a system used at many filling stations, where customers can pay for their fuel by inserting a credit card, debit card, or fuel card into. Paying Gas with Cash. If you use cash, you eliminate the credit card surcharge and you end up paying the lower advertised price. Some gas stations are actually. These gas cards typically offer from 1% back on your purchases – including 1%-3% back automatically whenever you buy gasoline from any service station. Select your savings, every day with the Phillips 66®, Conoco® or 76® Credit Cards. Apply online today. Earn 5 cents per gallon in Rewards when you pay using. Insert your card into the pump and choose credit or debit, you're ready to get started, using these tips to avoid card skimming devices. The Exxon Mobil Smart Card+ gas credit card gives you instant savings at the pump, plus fuel rewards and convenience store savings. Get the best gas credit. If you have used a Home Depot gas card, you'll love our gas credit card from Fuel Express. You can use it at virtually any fuel location in the country. How much more do gas stations charge when you use a credit card? Gas stations charge an average of 5 to 10 cents more per gallon for credit card purchases. With the Sunoco Rewards Credit Card, enjoy 5¢ off every gallon of gas*, every time you fill up at a Sunoco station. There are no limits or restrictions. The GasBuddy™ Mastercard® Credit Card gives drivers a discount on gas at the pump wherever Mastercard is accepted. All GasBuddy credit cardholders can save up. Gas rewards credit cards reward you with cash back or points equal to a percentage of each dollar you spend on gas, which may be a rate of 3% to 5%. You can compare cards side-by-side, plus get info about rewards, points, interest rates, and how to apply — all in one place. Compare gas rewards credit cards: earn points or cash back on fuel purchases and other spending categories. With the Sunoco Rewards Credit Card, enjoy 5¢ off every gallon of gas*, every time you fill up at a Sunoco station. There are no limits or restrictions. With a Discover gas credit card, you earn 2% cash back at gas stations and restaurants on up to $1, in combined purchases each quarter, automatically. And. Chevron® and Texaco® Techron Advantage credit cards provide convenient options for purchasing fuel and, retail items at our service stations. Earn up to an extra in Fuel Credits When using your Techron Advantage Visa Card at non-fuel merchants, if you spend $, you earn 2¢/gal. You earn 2¢/gal. more. Simplify Expenses With One Card · Business Visa Card For All Your Expenses. Use RoadFlex physical and virtual cards anywhere VISA is accepted. · Set Precise. The PenFed Platinum Rewards Visa Signature® Card is a top choice for gas rewards if you prefer banking with a credit union. The Citi Custom Cash® Card can earn 5% cash back on up to $ in gas purchases each month, if gas is your top spending category.

Dffvx Stock Price

Get the latest DFA U.S. Targeted Value Portfolio Institutional Class (DFFVX) real-time quote, historical performance, charts, and other financial. Unsystematic risk is the risk that events specific to Us Targeted or Dimensional Fund Advisors sector will adversely affect the stock's price. This type of risk. DFA U.S. Targeted Value Portfolio Institutional Class DFFVX:NASDAQ · 52 Week High · 52 Week High Date07/31/24 · 52 Week Low · 52 Week Low Date10/27/ Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. DFA U.S. Targeted Value Portfolio. DFA US Targeted Value I DFFVX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution. Morningstar Category: Small-value portfolios invest in small U.S. companies with valuations and growth rates below other small-cap peers. Stocks in the. Large Growth, ; Large Value, ; Small Growth, ; Small Value, ; Foreign Stock, Ticker Symbol+: DFFVX. Sub Account Details. Risk/Return Category1A. Aggressive The market universe is comprised of companies listed on the New York Stock. DFA U.S. Targeted Value Portfolio Institutional Class DFFVX ; NAV, Change, Net Expense Ratio, YTD Return ; $, 0 (%), % ; Quote data as of close 09/06/. Get the latest DFA U.S. Targeted Value Portfolio Institutional Class (DFFVX) real-time quote, historical performance, charts, and other financial. Unsystematic risk is the risk that events specific to Us Targeted or Dimensional Fund Advisors sector will adversely affect the stock's price. This type of risk. DFA U.S. Targeted Value Portfolio Institutional Class DFFVX:NASDAQ · 52 Week High · 52 Week High Date07/31/24 · 52 Week Low · 52 Week Low Date10/27/ Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. DFA U.S. Targeted Value Portfolio. DFA US Targeted Value I DFFVX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution. Morningstar Category: Small-value portfolios invest in small U.S. companies with valuations and growth rates below other small-cap peers. Stocks in the. Large Growth, ; Large Value, ; Small Growth, ; Small Value, ; Foreign Stock, Ticker Symbol+: DFFVX. Sub Account Details. Risk/Return Category1A. Aggressive The market universe is comprised of companies listed on the New York Stock. DFA U.S. Targeted Value Portfolio Institutional Class DFFVX ; NAV, Change, Net Expense Ratio, YTD Return ; $, 0 (%), % ; Quote data as of close 09/06/.

Historical stock closing prices for DFA U.S. Targeted Value Portfolio Inst (DFFVX). See each day's opening price, high, low, close, volume, and change %. Stock Market Today: Stocks tumble on growth worries: Nvidia leads tech slump. The S&P had its second-worst day of the year to kick off the month of. Value stocks typically trade at low prices relative to performance. These Dimensional U.S. Targeted Value Portfolio (DFFVX)3; TIAA-CREF Small-Cap. stock price, growth, DFFVX Performance - Review the performance history of the DFA US Summary. by Daniel Sotiroff Jan 19, DFA US Targeted Value. DFFVX, ; S&P TR USD, ; Category (SV), ; +/- S&P TR USD, Find the latest DFA US Targeted Value I (DFFVX) stock quote, history, news and other vital information to help you with your stock trading and investing. At the last closing, U.S. TARGETED VALUE PORTFOLIO U.S. TARGETED VALUE PORTFOLIO - INSTITUTIONAL CLASS's stock price was USD U.S. TARGETED VALUE. Stocks · Bonds. Investing Ideas. Home. Tools. Sections. Markets Price · Portfolio · People · Parent. Sponsor Center. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information. Total Assets 13,,, ; Total Liabilities 1,,, ; Net Assets 12,,, ; Month 1 NAV Shares Sold ,, ; Month 1 NAV Shares Reinvested 0. Previous close. The last closing price. $ ; YTD return. Year to date return as of Jul 31, % ; Expense ratio. Percentage of fund assets used for. DFFVX - Dfa Investment Dimensions Group Inc - DFA U.S. Targeted Value Portfolio Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). View the latest DFA US Targeted Value Portfolio;Institutional (DFFVX) stock price, news, historical charts, analyst ratings and financial information from. Real time DFA Investment Dimensions Group Inc. - U.S. Targeted Value Portfolio (DFFVX) stock price quote, stock graph, news & analysis. Get powerful stock screeners & detailed portfolio analysis. Subscribe NowSee Plans & Pricing · ios android. TipRanks is a comprehensive research tool. Best Dividend Capture Stocks ››. Quickest stock price recoveries post dividend payment. This trading strategy invovles purchasing a stock just before the ex. DFFVX. Inception Date. 02/23/ NAV as of 09/06/ $ Annual ETF shares trade at market price and are not individually redeemable with. Ticker Symbol+: DFFVX. Sub Account Details. Risk/Return Category1A. Aggressive The market universe is comprised of companies listed on the New York Stock. Investment style (stocks), Market Cap: Small Investment Style: Value ; Launch date, ; Price currency, USD ; Domicile, United States ; Symbol, DFFVX. Japan Stock. DISVX. DFA International Small Cap Value Port. %. 1-YEAR Rowe Price Funds for Retirement. Found in many (k) plans, these funds.

How Does Debt Settlement Affect Your Credit Score

Other companies could pocket the money you send in, instead of distributing it among your respective creditors, leaving you with poorly impacted credit. If. If you are in arrears with your Credit Cards or other finance, you are already in trouble with your Credit Score, so these “consolidation. A settlement doesn't negatively affect your credit scores. There is absolutely no difference scorewise between paying in full or settling. A collection on a debt of less than $ shouldn't affect your score at all, but anything over $ could cause a big drop. While debt settlement may seem like an easy fix to credit card debt problems, the long-term damage it does to your credit probably is not worth it. Before. If you pay a reduced amount in settlement of the debt, the credit report may reflect a notation such as "PAID IN SETTLEMENT FOR LESS THEN THE FULL BALANCE". Debt consolidation has no significant impact on your credit rating. It is merely a way of simplifying your financial life and reducing the interest that you're. In addition, failure to make required payments on your debts will negatively affect your credit score. Creditors are under no legal obligation to accept a. Yes, debt settlement does affect your credit and will show a settlement on your credit report. Some lenders could become leery or not willing to. Other companies could pocket the money you send in, instead of distributing it among your respective creditors, leaving you with poorly impacted credit. If. If you are in arrears with your Credit Cards or other finance, you are already in trouble with your Credit Score, so these “consolidation. A settlement doesn't negatively affect your credit scores. There is absolutely no difference scorewise between paying in full or settling. A collection on a debt of less than $ shouldn't affect your score at all, but anything over $ could cause a big drop. While debt settlement may seem like an easy fix to credit card debt problems, the long-term damage it does to your credit probably is not worth it. Before. If you pay a reduced amount in settlement of the debt, the credit report may reflect a notation such as "PAID IN SETTLEMENT FOR LESS THEN THE FULL BALANCE". Debt consolidation has no significant impact on your credit rating. It is merely a way of simplifying your financial life and reducing the interest that you're. In addition, failure to make required payments on your debts will negatively affect your credit score. Creditors are under no legal obligation to accept a. Yes, debt settlement does affect your credit and will show a settlement on your credit report. Some lenders could become leery or not willing to.

If you do it right, debt consolidation will only cause a minor hit to your credit, after which your scores should quickly rebound. After that, paying down the. Getting debts settled improves your debt-to-income ratio, which is one of the strongest influences on your credit score. If so, that settlement could appear on your credit report for about seven years and may damage your credit score. Ask your credit card company to report the. Debt settlement will affect your credit score, but not as negatively as a bankruptcy. How much can you save with debt settlement? To understand the. Debt Settlement Will Most Likely Hurt Your Credit Score. Debt settlement is likely to lower your credit score by as much as points or more. But it's. However, if your credit counselor arranges for you to pay less than what you owe, called debt settlement, your credit score will be affected negatively. Yes. Debt settlement will negatively affect your credit score for up to seven years. That's because, to pressure your creditors to accept a settlement offer. If creditors accept your debt settlement plan, your debt will be erased but your credit score will be adversely impacted because you were unable to pay the debt. Credit score impact: Debt settlement companies often advise their clients to stop paying creditors. Missing payments profoundly impacts credit scores — causing. Paying off a collection could cause the score to increase, decrease or have no impact at all. It depends on the change in the information reported on the. Yes, debt settlement does affect your credit and will show a settlement on your credit report. Some lenders could become leery or not willing to. Installment accounts (loans) generate an I7 notation. These types of notations will negatively affect your credit score. However, the amount of time these. Negative impact to your credit score: There's no way getting around it — debt settlement will ultimately hurt your credit score. That can make it difficult to. Negative impact to your credit score: There's no way getting around it — debt settlement will ultimately hurt your credit score. That can make it difficult to. If you do it right, debt consolidation will only cause a minor hit to your credit, after which your scores should quickly rebound. After that, paying down the. Because you may have to stop making your payments on your credit cards, debt settlement results in a temporary negative impact to your FICO credit scores and. If you are in arrears with your Credit Cards or other finance, you are already in trouble with your Credit Score, so these “consolidation. Will Debt Settlement Affect My Credit Score? If you are current on your payments, it is very difficult, if not impossible to settle your debt. Creditors. How Do You Repair Your Credit After Debt Settlement? Debt settlement stays on your credit report for seven years, starting on the first date of your delinquency. There might be a negative impact on your credit report and credit score. Debt settlement programs often ask — or encourage — you to stop sending payments.

Tasks Of An Executive Assistant

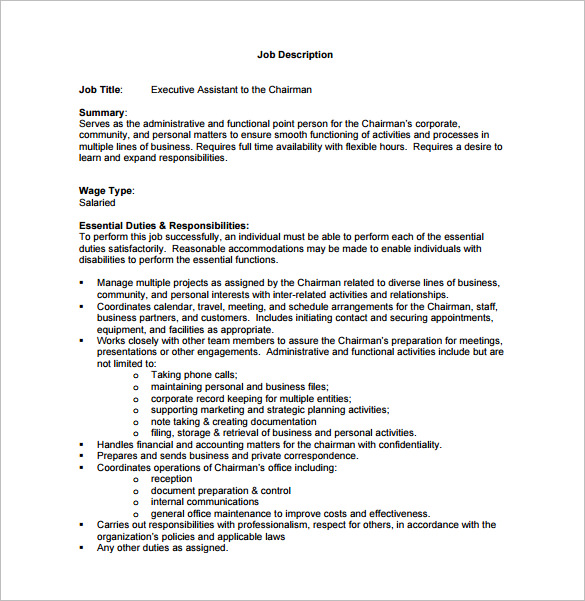

Tasks · Manage and maintain executives' schedules. · Make travel arrangements for executives. · Prepare invoices, reports, memos, letters, financial statements. Responsibilities: · Manage and maintain the executive's calendar, schedule appointments, and coordinate meetings. · Prepare agendas, presentations, and reports. Responsibilities · Manage professional and personal scheduling for CEO, including agendas, mail, email, phone calls, client management, and other company. What do executive assistants do? · manages my priorities day to day and week to week (following up on tasking, contracting, HR, finances, my. General Executive Office Administrative Duties ○ Coordinates meetings and events for the President's Office, which may include catering, travel. Build your own Executive Assistant job description using our guide on the top skills, education, experience and more. Post your job today. Executives often hire an executive assistant who can manage tasks like calendar management, bookings, and answering the phone. Complete a broad variety of administrative tasks that facilitate the CEO's ability to effectively lead the organization, including: assisting with special. Sample Executive Assistant Job Description · Manage all personal affairs for Founder including, but not limited to: booking personal appointments, reservations. Tasks · Manage and maintain executives' schedules. · Make travel arrangements for executives. · Prepare invoices, reports, memos, letters, financial statements. Responsibilities: · Manage and maintain the executive's calendar, schedule appointments, and coordinate meetings. · Prepare agendas, presentations, and reports. Responsibilities · Manage professional and personal scheduling for CEO, including agendas, mail, email, phone calls, client management, and other company. What do executive assistants do? · manages my priorities day to day and week to week (following up on tasking, contracting, HR, finances, my. General Executive Office Administrative Duties ○ Coordinates meetings and events for the President's Office, which may include catering, travel. Build your own Executive Assistant job description using our guide on the top skills, education, experience and more. Post your job today. Executives often hire an executive assistant who can manage tasks like calendar management, bookings, and answering the phone. Complete a broad variety of administrative tasks that facilitate the CEO's ability to effectively lead the organization, including: assisting with special. Sample Executive Assistant Job Description · Manage all personal affairs for Founder including, but not limited to: booking personal appointments, reservations.

An Executive Administrative Assistant is an employee who provides high level administrative support to executives in the workplace. An executive assistant is a professional that handles and manages the communication and schedules of companies' key executives. JOB DESCRIPTION: EXECUTIVE ASSISTANT TO THE EXECUTIVE DIRECTOR. POSITION SUMMARY: Reporting directly to the Executive Director, the Executive Assistant. We're hiring an executive assistant to provide administrative support to the team lead and help us achieve our organizational goals. Extensive calendar management is the foremost duty of an executive assistant. It involves organizing and coordinating the schedule of the executives they. Executive Assistant Responsibilities: · Take minutes during meetings · Act as the link between upper management and the broader staff · Organize travel and. Today many assistants are taking on more-supervisory roles: They're managing information flow, dealing with basic financial management, attending meetings, and. Performs clerical and administrative tasks including drafting letters, memos, invoices, reports, and other documents for senior staff. Arranges travel and. An executive assistant is, as the name suggests, someone whose primary role is to assist or support a high-level executive. C-suite executives have a lot on. The Executive Assistant will provide high-level administrative support to the Executive Director and other senior staff. Supervisory Responsibilities: May. An executive assistant's most basic role is to support you in a way that makes your role more effective, efficient, and successful. Job Brief: We are seeking an executive assistant to be the supportive force that empowers our client and their executives. The perfect person for the role will. Furthermore, executive assistants may engage in strategic tasks such as conducting research, analyzing data, and participating in decision-making processes. The Executive Assistant helps to maintain the executive's schedule, manage their communications, and assist with special projects. As a company Founder or CEO, you may be looking for an executive assistant to schedule meetings, organize business trips, as well as manage many aspects of your. What are the duties of an Executive Assistant? · Managing and organising calendars · Making travel arrangements (such as booking taxis for executives) · Answering. We help you understand how to write an effective job description and what mistakes to avoid. We also share a free template so you can start crafting your. Job Responsibilities · Setting and managing the daily schedules and calendars of company executives · Preparing and/or editing documents, such as expense reports. A Summary Of Executive Assistant Responsibilities · Managing calendars and appointments for company leadership. · Handling communications for company leaders. Executive Assistant Role and Responsibilities · Act as an executive's point of contact for employees, clients, and all external parties. · Handle the.

Best Markets To Buy A Home

.png)

1. Thousand Palms. We've identified the zip code in Thousand Palms as California's best real estate investment market. · 2. Bakersfield · 3. Madera · 4. Salem is the best place to buy rental property in Oregon, followed by Portland and Hillsboro. Learn how population growth has spurred increasing home values and. Best Places to Buy a Vacation Home · 1. Poconos, PA · 2. Indio / Bermuda Dunes, CA · 3. Dauphin Island / Gulf Shores / Orange Beach, AL · 4. Logan, OH · 5. Research has shown that people purchase homes in areas that provide a secure and stable environment for their families. Thus, areas with a low violent crime. Top markets include Puerto Vallarta on the Pacific coast and Playa del Carmen on the Riviera Maya. In both of these popular tourist towns, a rental property can. China has the richest real estate market globally, with assets worth $ trillion, representing 21% of the global real estate value. The US comes in second. Chicago. Market has been flat for 15 years and is due for a boom. Condos in the best areas can be had for under k. No car needed. Inventory (available homes for sale) went up % in Texas in the last year, which means you'll have more options if you're wanting to buy a house. On average. Real Estate Initiative · CENTERS & TRADING ROOM · Overview · Adams Center for Note: For the best user experience, please view the charts on a desktop. 1. Thousand Palms. We've identified the zip code in Thousand Palms as California's best real estate investment market. · 2. Bakersfield · 3. Madera · 4. Salem is the best place to buy rental property in Oregon, followed by Portland and Hillsboro. Learn how population growth has spurred increasing home values and. Best Places to Buy a Vacation Home · 1. Poconos, PA · 2. Indio / Bermuda Dunes, CA · 3. Dauphin Island / Gulf Shores / Orange Beach, AL · 4. Logan, OH · 5. Research has shown that people purchase homes in areas that provide a secure and stable environment for their families. Thus, areas with a low violent crime. Top markets include Puerto Vallarta on the Pacific coast and Playa del Carmen on the Riviera Maya. In both of these popular tourist towns, a rental property can. China has the richest real estate market globally, with assets worth $ trillion, representing 21% of the global real estate value. The US comes in second. Chicago. Market has been flat for 15 years and is due for a boom. Condos in the best areas can be had for under k. No car needed. Inventory (available homes for sale) went up % in Texas in the last year, which means you'll have more options if you're wanting to buy a house. On average. Real Estate Initiative · CENTERS & TRADING ROOM · Overview · Adams Center for Note: For the best user experience, please view the charts on a desktop.

Investing in real estate includes purchasing a home, rental property, or land. Indirect investment in real estate can be made via REITs or through pooled real. Search homes for sale, new construction homes, apartments, and houses for rent. See property values. Shop mortgages. com/blog/best-rental-property-markets Reply reply. SPACE_SHAMAN. •. Buy a bunch of homes in a single area, dont do anything with them. Buy Now Pay Later (BNPL) AppsBest Debt Relief. Credit Monitoring. +More for buying a home so you can ride out any market dips. And keep in mind that. We created an updated index of the best places to invest in using AirDNA's property-level performance data for Airbnb and Vrbo. Hi guys, I am a newbie and looking for my first investment property. I will in CA but dont want to invest here for obvious reasons. Townhouse in Buffalo, New York CEW / fujikura-sale.ru ; Tampa, Florida picturin / fujikura-sale.ru ; House in Orlando, Florida Tom Fawls / fujikura-sale.ru ; House. The Top Real Estate Markets in North Carolina Right Now · High Point · 9. Greenville · 8. Fayetteville · 7. Wilmington · 6. Asheville · 5. Durham · 4. China is home to more of the world real estate market assets (by value) than any other country at $tn or 21 per cent of global real estate value. China is home to more of the world real estate market assets (by value) than any other country at $tn or 21 per cent of global real estate value. For example, the fastest growing real estate market over the last year was Blytheville, AR with a % jump in home prices. Rounding out the top five are San. So what's the best approach to buying a home in a competitive market? The answer may differ from buyer to buyer, but there are certain tried-and-true strategies. For example, the fastest growing real estate market over the last year was Blytheville, AR with a % jump in home prices. Rounding out the top five are San. Read the latest real estate housing market news and housing market price news from HousingWire. Get expert insights, breaking news and more. The leading real estate marketplace. Search millions of for-sale and rental listings, compare Zestimate® home values and connect with local professionals. The Top Real Estate Markets in North Carolina Right Now · High Point · 9. Greenville · 8. Fayetteville · 7. Wilmington · 6. Asheville · 5. Durham · 4. Despite a % increase in home prices over a three-year period, Huntsville still sits among the top 10 undervalued housing markets, according to NAR. It was. Orlando Metro: Best for Traditional Investors There are many things that make Orlando one of the best places for traditional investors to invest in Florida. If you're looking for a stable and predictable market where you can buy property to fix and flip, consider the Virginia Beach area. The average profit for a. 🗺️ Buying a house in the Missouri real estate market Missouri has an affordability score of , meaning it takes years of the median household income ($.

Referral Tracking

Health centers must have a solid system in place for tracking referrals. Ensuring compliance requires a collaborative effort from both health center staff and. Working with Referrals. Tracking Referral Activity. Related Training. Managing Referrals Recorded Class. The Referral Activity feature enables you to track. Our referral tracking software offers you everything you need to automate the management and tracking of your referral marketing program. Say goodbye to your. Data displayed in tabular form also helps User to track the work done by a particular 'Referral Coordinator'. All: Check/Select this field and click on GO. Referral tracking is the process of monitoring and keeping track of your referral campaign's results. Referral tracking is the process of associating each program member (referrer) with the referrals they send and tracking the progression of a new referral from. Referral Tracking: Why is it so important for your referral program Effective referral marketing programs have two things: a defined goal and a way to track. Referral tracking means collecting data across the entire referral process; from a customer registering to become a referrer, to them sharing a referral. ChamberForge is a leading referral tracking tool for business networking groups, referral groups, leadshare groups, and busineses. Health centers must have a solid system in place for tracking referrals. Ensuring compliance requires a collaborative effort from both health center staff and. Working with Referrals. Tracking Referral Activity. Related Training. Managing Referrals Recorded Class. The Referral Activity feature enables you to track. Our referral tracking software offers you everything you need to automate the management and tracking of your referral marketing program. Say goodbye to your. Data displayed in tabular form also helps User to track the work done by a particular 'Referral Coordinator'. All: Check/Select this field and click on GO. Referral tracking is the process of monitoring and keeping track of your referral campaign's results. Referral tracking is the process of associating each program member (referrer) with the referrals they send and tracking the progression of a new referral from. Referral Tracking: Why is it so important for your referral program Effective referral marketing programs have two things: a defined goal and a way to track. Referral tracking means collecting data across the entire referral process; from a customer registering to become a referrer, to them sharing a referral. ChamberForge is a leading referral tracking tool for business networking groups, referral groups, leadshare groups, and busineses.

The Referral Tracker Pro (RTP) is directly connected to hospital EHR interfaces. As the acute care provider presents a referral for discharge, you instantly. Company Logo. Referral Tracker System. User Name: required; Password: required; Forgot My Password; Remember Me Next Time. Tracking referrals feature lets you track each referral. Referral Software with Referral Tracking · Birdeye Referrals · PartnerStack · Tremendous · Giftbit · Talkable · Levanta · Post Affiliate Pro · Kangaroo. What is referral tracking? Referral tracking is the process of monitoring and measuring the effectiveness of your referral marketing efforts. Our referral tracking software offers you everything you need to automate the management and tracking of your referral marketing program. Say goodbye to your. Referral tracking is a strategy that helps businesses identify and track referral sources, optimize referral programs, and increase conversions and sales. A fujikura-sale.ru Service. Child Abuse Referral Tracking. Track A Referral. Search with the Referral ID. Referral ID. Home · Help and FAQs · Privacy Statement. The Best Referral Tracking and Reward Program For eCommerce · Hyper intuitive user interfaces that make referring extremely easy · Reward both the sender and. ReferTrac is proven referral tracking software for financial institutions that increases cross-sales and makes a seamless referral process. Referral Tracking allows your practice to efficiently organize outbound referrals, auto-assign them to various teams, add notes, document specialist. Referral Tracking. Referrals are an integral part of a dental practice. – Patients are referred out of a practice to see other providers for specialized care. Run a referral report · Log in to the OpenTable for Restaurants website. · Open the menu and navigate to Reporting. · Select Referrals in the left-panel. Log in to LeadSimple and click "Add Lead Type" in the sidebar. Name the pipeline "Referrers" and give it an item name of "Referrer", then click "Save". This. Printable Referral Tracker, Client Referral Tracking, Referrals Worksheet, Referrals Log, Referral Contacts, Referral Sheet, A4 and Letter. You can use a Business API or a flow action to create records that track the activities of advocates and their referred friends. Referral tracking software allows you understand who advocates are sharing with, what drives them to share, and where they want to share a referral. Get more leads on autopilot by adding referral tracking to your typeform with no code. GrowSurf customers enjoy results like these: % return on. 1. Set up a tracking system with some software. There are plenty of referral tracking tools available. Leadfellow is one of them:) 2. Use unique referral links. fujikura-sale.ru: Referral Tracker Log Book: Track and Manage Your Referrals: Zaggoudi, Ahmed: Books.

Best Recommended Credit Cards

Credit Cards for Excellent Credit · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card. Showing credit cards ; Capital One QuicksilverOne Cash Rewards Credit Card · reviews ; Citi Rewards+® Card · reviews ; Citi Simplicity® Card · reviews. Best for bonus offer: Capital One Venture Rewards Credit Card; Best for point value: Chase Sapphire Preferred® Card; Best standalone rewards card. Learn about top cards from our partners ; Blue Cash Preferred® Card from American Express. Blue Cash Preferred® Card from American Express ; The Platinum Card®. Browse the best credit cards of for cash back, travel rewards, 0% APR, credit building and more. Find the best one for you and apply in seconds. Which of Citi's Most Popular Credit Cards is the best credit card for you? · Browse Our Card Categories · Citi® / AAdvantage® Platinum Select® World Elite. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at fujikura-sale.ru Capital One Venture Rewards Credit Card: Best for non-bonus spending · Chase Sapphire Preferred® Card: Best for beginner travelers · Ink Business Preferred®. Credit Cards for Excellent Credit · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card. Showing credit cards ; Capital One QuicksilverOne Cash Rewards Credit Card · reviews ; Citi Rewards+® Card · reviews ; Citi Simplicity® Card · reviews. Best for bonus offer: Capital One Venture Rewards Credit Card; Best for point value: Chase Sapphire Preferred® Card; Best standalone rewards card. Learn about top cards from our partners ; Blue Cash Preferred® Card from American Express. Blue Cash Preferred® Card from American Express ; The Platinum Card®. Browse the best credit cards of for cash back, travel rewards, 0% APR, credit building and more. Find the best one for you and apply in seconds. Which of Citi's Most Popular Credit Cards is the best credit card for you? · Browse Our Card Categories · Citi® / AAdvantage® Platinum Select® World Elite. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at fujikura-sale.ru Capital One Venture Rewards Credit Card: Best for non-bonus spending · Chase Sapphire Preferred® Card: Best for beginner travelers · Ink Business Preferred®.

Visa Credit Cards · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Self - Credit Builder Account with Secured Visa® Credit Card · Wells Fargo Reflect®. Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. Recommended credit cards · My favorite rewards credit cards · Fidelity Rewards Visa Signature · Fidelity® Rewards Visa Signature® Card · Amex Blue Cash Preferred®. For example, Navy Federal Credit Union's nRewards® Secured card offers point rewards while you build your credit, with the potential to upgrade to cashRewards. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. Recommended Credit Card Offers. I receive compensation for many links on this blog. You don't have to use these links, but I am grateful to you if you do. I. Credit Cards · Bankrate's promoted cards from our partners for September · BEST FOR EVERYDAY CASH REWARDS · Wells Fargo Active Cash® Card · BEST STARTER TRAVEL. A good travel credit card (or a few) is a tool that all financially responsible travelers should be using. However, knowing which travel credit card(s) to apply. Why this credit card is one of the best: Chase Freedom Unlimited charges no annual fee and earns 5% cash back on travel purchased through Chase Ultimate Rewards. The American Express® Gold Card is ideal for earning travel rewards on common everyday spending categories like dining and groceries. Answer a few quick questions to find the perfect credit card for you. We choose from of the top travel and cash rewards credit cards based on your. ShopYourWay (SYW) card hands down. I've earned % back overall on about $75, of spending on that card in the last 3 years. For transferrable rewards, the Capital One Venture X is tops; for travel perks, we like the Amex Platinum Card®; and for the best starter travel card, go for. Why this credit card is one of the best: Chase Freedom Unlimited charges no annual fee and earns 5% cash back on travel purchased through Chase Ultimate Rewards. Credit Cards Archive ; BankAmericard Review: A Great Breather From Credit Card Interest. ; Capital One Venture Review: Easy Earnings, Effortless Redemptions. My recommended ; beginner ; Wanderluster · Chase Sapphire Reserve® ; credit · Chase Sapphire Preferred® Card ; Finer things ; new businesses · Capital One Spark Cash. If Southwest is your airline of choice, the Southwest Rapid Rewards® Priority Credit Card provides you with a $75 Southwest travel credit and 7, Rapid. These companies are payment networks that process transactions, they do not actually issue credit cards. Benefits associated with your credit card comes from. Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Wells Fargo Reflect® Card · Ink Business Unlimited® Credit Card · Chase Sapphire Preferred® Card · Capital.

1 2 3 4 5