fujikura-sale.ru

Community

What Is The Most User Friendly Tax Software

I use H&R Block (what used to be TaxCut) Premium + Business. Haven't had any issues, and the forms are updated regularly before filing. I do. Because our reliable research and user-friendly software supports a more manageable workload, you'll have more time for strategic planning. How Bloomberg. H&R Block is a well-known name in the tax preparation industry. Several reviews named it the top tax software of for its overall performance, ease of use. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Our Top Tested Picks · Intuit TurboTax (Tax Year ) · H&R Block (Tax Year ) · FreeTaxUSA (Tax Year ) · TaxAct (Tax Year ). Sprintax is a great tool for filing state and federal taxes in the US. Their interface is very user-friendly and I found the customer chat service really useful. Best Overall: H&R Block · Best for Ease of Use: Jackson Hewitt · Best Online Experience: TurboTax Live · Best for Self-Employed: EY TaxChat. Prepare more tax returns with greater accuracy and efficiency with TaxWise® TaxWise® provides tax preparers with the industry's leading professional tax. Below are IRS Free File tax preparation and filing services from trusted partners for you to explore. For best results, use the IRS Free File "Find Your. I use H&R Block (what used to be TaxCut) Premium + Business. Haven't had any issues, and the forms are updated regularly before filing. I do. Because our reliable research and user-friendly software supports a more manageable workload, you'll have more time for strategic planning. How Bloomberg. H&R Block is a well-known name in the tax preparation industry. Several reviews named it the top tax software of for its overall performance, ease of use. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. Our Top Tested Picks · Intuit TurboTax (Tax Year ) · H&R Block (Tax Year ) · FreeTaxUSA (Tax Year ) · TaxAct (Tax Year ). Sprintax is a great tool for filing state and federal taxes in the US. Their interface is very user-friendly and I found the customer chat service really useful. Best Overall: H&R Block · Best for Ease of Use: Jackson Hewitt · Best Online Experience: TurboTax Live · Best for Self-Employed: EY TaxChat. Prepare more tax returns with greater accuracy and efficiency with TaxWise® TaxWise® provides tax preparers with the industry's leading professional tax. Below are IRS Free File tax preparation and filing services from trusted partners for you to explore. For best results, use the IRS Free File "Find Your.

TurboTax, H&R Block, and TaxAct have an easy-to-use interface, are mobile friendly and offer e-filing options, making for an organized process. Olt Pro started as a cloud-based tax preparation solution, but now it also offers desktop software. It could stand to be more user-friendly. Not ideal for. Drake Tax is used by small- to medium-sized businesses that are primarily looking to file their returns. Because the system doesn't excel in handling more. The TaxSlayer app is both easy to use and versatile. It walks you through the tax return preparation and e-filing process, and then gives you four options . TurboTax has the interface most liked by users and reviewers, making tax filing speedier and easier. This could become even more efficient with the addition of. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. Easy to use and a fraction of the cost of the other alternatives. TurboTax is the best tax software for tax preparers. With some really pleasant features for tax filing, they even help you after filing your taxes, if you want. our experience with this software started when we were searching for a new tool for taxes, it was really smooth and seems easy to learn how to use it. Read. Drake Software is a complete professional tax preparation program for federal and state returns, business and individual. See why professional preparers. Tax Hawk also owns and operates FreeTaxUSA. It remains a popular choice for tax bargain hunters. While the software is dated, it is simple to navigate. The. H&R Block's tax and accounting software programs are some of the best, winning most of their points for being user-friendly and offering exceptional support. The ever-popular TurboTax is easy to use, has app support (multiple apps for self employed, tracking, etc), and includes live support. Reviewing. TurboTax has a well-earned reputation for ease of use and an intuitive interface that makes it easy for filers to move across their forms with ease and without. Find out why these tax professionals chose UltraTax CS · “Our firm chose UltraTax because it provides a really great balance between ease of use, simplicity in. TaxSlayer Pro's user-friendly interface and intuitive navigation make it easy for tax professionals to accurately input data and prepare tax returns. 5. Drake. We considered eight of the most popular tax preparation software in the U.S, including Cash App, TurboTax, TaxAct, TaxSlayer, H&R Block, Jackson Hewitt. You can import most tax PDF forms—so adding and W-2 forms is fairly painless. The clean user interface and extensive guidance videos should make your tax. The company offers user-friendly, feature-rich tax preparation software for both desktop and online platforms. Keystone Tax Solutions provides tax preparers. MilTax is a suite of free tax services for the military from the Defense Department, including easy-to-use tax preparation and e-filing software. The easiest to use, most complete professional tax software for CPAs and small firms. Don't just take our word for it; ATX was rated easiest to use in The Tax.

What Is The Best Broker For Short Selling

Because you're borrowing shares from a brokerage firm, you must first establish a margin account to hold eligible assets like bonds, cash, mutual funds, or. To capitalize on this expectation, the trader would enter a short-sell order in their brokerage account. When filling in this order, the trader has the option. Our recommended brokers: · Plus · eToro · EVEST · DEGIRO · MyFundedFX. The disparity between risk and return is the inherent risk of shorting. Theoretically speaking, when an investor goes long a stock, the maximum loss is when. Your needs should be well-served by any of the larger brokerages -- Interactive, TOS, Tasty, Tradier, Trade Zero, etc. When calculating the cost of borrowing stock at Interactive Brokers, a borrow fee and short sale proceeds interest are the factors for daily cost/revenues. The Best Brokerage for Short Selling in · eToro · Webull · Interactive Brokers · TD Ameritrade · Charles Schwab · Cobra Trading. Our Debit Securities service allows you to short sell. This service facilitates the possibility of short selling cash market securities, such as stocks and. Interactive Brokers: Best for on-exchange short trading Interactive Brokers offers on exchange DMA trading so you can short stocks and markets with direct. Because you're borrowing shares from a brokerage firm, you must first establish a margin account to hold eligible assets like bonds, cash, mutual funds, or. To capitalize on this expectation, the trader would enter a short-sell order in their brokerage account. When filling in this order, the trader has the option. Our recommended brokers: · Plus · eToro · EVEST · DEGIRO · MyFundedFX. The disparity between risk and return is the inherent risk of shorting. Theoretically speaking, when an investor goes long a stock, the maximum loss is when. Your needs should be well-served by any of the larger brokerages -- Interactive, TOS, Tasty, Tradier, Trade Zero, etc. When calculating the cost of borrowing stock at Interactive Brokers, a borrow fee and short sale proceeds interest are the factors for daily cost/revenues. The Best Brokerage for Short Selling in · eToro · Webull · Interactive Brokers · TD Ameritrade · Charles Schwab · Cobra Trading. Our Debit Securities service allows you to short sell. This service facilitates the possibility of short selling cash market securities, such as stocks and. Interactive Brokers: Best for on-exchange short trading Interactive Brokers offers on exchange DMA trading so you can short stocks and markets with direct.

To engage in short selling, you need to open a margin account with a broker to be eligible. Borrowing a stock—the first step in the strategy—incurs additional. Reporting Requirements. In , the SEC introduced new rules requiring investors to report their short positions and the brokers that lend out securities to. You must have enough cash in your stock trading account to cover the required margin – margin requirements vary among brokers. Example – How a Short Trade Plays. better short and long selling ordeal. Variables like spread Traditionally, to short-sell shares, you sell and buy shares via your broker yourself. Best Brokers for Short Selling Stocks · 1. TradeZero: Best Tools for Short Selling · 2. Interactive Brokers: Best for Seasoned Traders · 3. Firstrade: Best for. Our recommended brokers: · Plus · eToro · EVEST · DEGIRO · MyFundedFX. Short selling is easily possible with high-quality brokers and hardly causes any additional work; As with all stock market activities, there is a fundamental. This lesson neatly summarizes the key concepts and requirements facing investors wanting to sell short stocks at Interactive Brokers. To engage in short selling, you need to open a margin account with a broker to be eligible. Borrowing a stock—the first step in the strategy—incurs additional. broker. If the Qtrade has a number of free resources that can help you to become better educated about short selling and stock trading in general. Opening and closing the trade can be done through regular trading platforms with brokers qualified to perform margin trading. To short-sell, traders commonly. eToro is a simple-to-use broker that is accessible for beginner traders, while offering all the functionality that an experienced trader needs. This is typically a practice of large institutions rather than individual investors, but some brokers will facilitate short-selling. How do you short a stock? First things first, you need to have an account with a broker that specializes in short inventory and locate services. Different brokers will have varying. Brokers typically have arrangements with large shareholders who receive a portion of the stock borrow fee in exchange for allowing the broker to loan their. Interactive Brokers - BEST ONLINE BROKER FOR DAY TRADING · Cobra Trading - BEST DAY TRADING PLATFORM FOR SHORT SELLING · Lightspeed Trading - BEST ONLINE BROKER. When an investor engages in short selling, two things can happen. If the FINRA and U.S. exchange rules require that brokerage firms report short. One very good feature of best stock brokers is good inventory of stocks to borrow when a trader wants to make a short sell trade. As you know, such a trade is. 10 Best Brokers For Short-Selling Forex Brokers. An overview of the brokers that made this list with their pros & cons. What is unified buying power | Margin & Leverage | Risk Management | Short Selling Risk.

Tax Free Crypto Trading

Calculate Your Crypto Taxes in 20 Minutes. Instant Crypto Tax Forms. Support For All Exchanges, NFTs, DeFi, and + Cryptocurrencies. Since the IRS treats cryptocurrency as property for tax purposes, crypto fees are tax deductible. Any time you buy, sell, trade, or mine crypto and incur. Buying crypto with cash and holding it: Just buying and owning crypto isn't taxable on its own. The tax is often incurred later on when you sell, and its gains. Charitable crypto donations can be tax deductible. · It's important to stress here that buying cryptocurrency using another cryptocurrency is a taxable event. A major consideration from a state tax perspective is whether or not the purchase of virtual currency or cryptocurrency is a taxable sale for sales and use tax. You should report the fair market value at the time of receipt of the cryptocurrency received in your tax return. How can I calculate taxes on NFTs. There is no tax for simply holding cryptocurrency. You won't be required to pay tax unless you dispose of your crypto or earn interest income on your. If you trade or exchange crypto, you may owe tax. Crypto transactions are taxable and you must report your activity on crypto tax forms to figure your tax. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law. Calculate Your Crypto Taxes in 20 Minutes. Instant Crypto Tax Forms. Support For All Exchanges, NFTs, DeFi, and + Cryptocurrencies. Since the IRS treats cryptocurrency as property for tax purposes, crypto fees are tax deductible. Any time you buy, sell, trade, or mine crypto and incur. Buying crypto with cash and holding it: Just buying and owning crypto isn't taxable on its own. The tax is often incurred later on when you sell, and its gains. Charitable crypto donations can be tax deductible. · It's important to stress here that buying cryptocurrency using another cryptocurrency is a taxable event. A major consideration from a state tax perspective is whether or not the purchase of virtual currency or cryptocurrency is a taxable sale for sales and use tax. You should report the fair market value at the time of receipt of the cryptocurrency received in your tax return. How can I calculate taxes on NFTs. There is no tax for simply holding cryptocurrency. You won't be required to pay tax unless you dispose of your crypto or earn interest income on your. If you trade or exchange crypto, you may owe tax. Crypto transactions are taxable and you must report your activity on crypto tax forms to figure your tax. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law.

The IRS treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results in either a. A You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of. Coinpanda makes it easy to generate your Bitcoin and crypto tax reports Free tax forms Download IRS Form and Schedule D instantly. Both trading cryptocurrencies and making transactions with them are totally tax-exempt. Neither VAT nor capital gains tax is paid. They're not considered. Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable. Available in 20+ countries. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency. Not to mention. Taxable income. If you receive cryptocurrency from mining, forks, airdrops (even unintentionally), or as a payment in exchange for goods/services, you must. Exchanging one crypto for another is a taxable event, regardless of whether it occurs on a centralized exchange or a DeFi exchange. If you trade 1 BTC for This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable. This page does not aim to explain how cryptoassets work. At tax time, you'll fold these gains into your regular income, then pay taxes on everything together at your ordinary income tax rate. Note: Those with incomes. Several countries do not tax cryptocurrency. The list includes Portugal, Malta, the United Arab Emirates, Germany, El Salvador, Georgia, Singapore, Hong Kong. Free Federal Tax Filing with Cryptocurrency · E-File Crypto Income, Mining and Investments to the IRS · Uploading crypto sales is fast and easy. · How to file with. Selling, trading, and buying goods with cryptocurrencies are taxable events. You may be able to manage your tax bill by tax-loss harvesting crypto losses. Transfer fees are not tax-deductible and cannot be used to reduce your taxable income. Trading fees: These are fees paid to a cryptocurrency exchange or broker. fujikura-sale.ru has everything you need to get started earning tax-free gains in your IRA or Roth IRA. · NO MONTHLY FEES · NO MAINTENANCE FEES · NO STORAGE FEES. Yes, converting one cryptocurrency to another is considered a taxable event and must be reported. How do I report crypto conversion on. 2. Do you get taxed for day trading crypto? Yes, if you are buying and selling cryptocurrencies on a daily basis then it is a taxable event. The IRS considers. Least Tax First Out is an exclusive algorithm that optimises your crypto taxes by using the asset lot with the highest cost basis whenever you trigger a. In the US, even if you trade a cryptocurrency for a stablecoin, you'll incur a taxable event. You might have a large capital gain tax bill even if you didn't. It's important to note that the taxable income on crypto is based on the fair market value at the time the income is received. Crypto salary. Your employer pays.

Amazon Trading Store

Items we accept will be purchased from you, and you will be paid for the items with an fujikura-sale.ru Gift Card(s) issued for the value of your trade-in. Find out if an item is accepted or rejected. View rejection reasons where relevant. Note: Depending on your location, trade-in items can take up to 10 business. The Amazon Trade-In program allows you to exchange eligible Trade-In items for an fujikura-sale.ru Gift Card for the assessed value of the Trade-In. Discover real-time fujikura-sale.ru, Inc. Common Stock (AMZN) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Online shopping for Trade-in from a great selection at Electronics Store. Limit three trade-in items per customer and account. Eligible devices include all Amazon Fire tablets except current generation tablets, and all Amazon Kindle. The Amazon Trade-in program allows customers to receive an fujikura-sale.ru Gift Card in exchange for thousands of eligible items including Amazon Devices. Amazon (company) ; Amazon's headquarters, the Doppler building ; Trade name. Amazon ; Formerly, Cadabra, Inc. (–) ; Company type, Public. Amazon Trade-In Program · Submit a Trade-In · Receiving Payment for a Trade-In · Find the Status of Your Trade-In · Cancel or Change Your Trade-In · Ship Your Trade-. Items we accept will be purchased from you, and you will be paid for the items with an fujikura-sale.ru Gift Card(s) issued for the value of your trade-in. Find out if an item is accepted or rejected. View rejection reasons where relevant. Note: Depending on your location, trade-in items can take up to 10 business. The Amazon Trade-In program allows you to exchange eligible Trade-In items for an fujikura-sale.ru Gift Card for the assessed value of the Trade-In. Discover real-time fujikura-sale.ru, Inc. Common Stock (AMZN) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Online shopping for Trade-in from a great selection at Electronics Store. Limit three trade-in items per customer and account. Eligible devices include all Amazon Fire tablets except current generation tablets, and all Amazon Kindle. The Amazon Trade-in program allows customers to receive an fujikura-sale.ru Gift Card in exchange for thousands of eligible items including Amazon Devices. Amazon (company) ; Amazon's headquarters, the Doppler building ; Trade name. Amazon ; Formerly, Cadabra, Inc. (–) ; Company type, Public. Amazon Trade-In Program · Submit a Trade-In · Receiving Payment for a Trade-In · Find the Status of Your Trade-In · Cancel or Change Your Trade-In · Ship Your Trade-.

I sent in an unlocked iPhone 12 Pro Max I bought at the Apple Store. The trade-in team rejected it stating it was marked in sellable by the carrier which is. Find the latest fujikura-sale.ru, Inc. (AMZN) stock quote, history, news and other vital information to help you with your stock trading and investing. Learn what Amazon is, its company story, the hours you can trade it via CFDs, and additional Amazon shares trading information. The latest Amazon stock prices, stock quotes, news, and AMZN history to help you invest and trade smarter. Trade in your Amazon Device and receive 20% off the purchase of a qualifying Amazon Device. Terms apply. Learn more about the Amazon Trade-In program. The Amazon Trade-In program allows customers to exchange Amazon devices and thousands of eligible electronics from other manufacturers. fujikura-sale.ru, Inc. provides a range of products and services to customers. The products offered through its stores include merchandise and content it has. Manage Your Amazon Seller Central account with the Amazon Seller App on the go. Stay up-to-date of your orders, inventory, advertising campaigns, and sales. Shop Collectible Avatars. We have encountered an error. Please try How strict is Amazon with trade-ins? General Question ❔. I have. Amazon FBA (Fulfillment By Amazon) is your inventory warehouse, manager, and shipper for a very small amount, compared to what you'd have to pay otherwise. On. Country Trading Co.® is a family-owned company that has been supporting culinary journeys for over 12 years. Because we believe real people in real kitchens. Online shopping for Online Trading from a great selection at Kindle Store Store. Shop All Slipcovered Furniture. Dining Room. Shop All Kitchen & Dining. All Slipcovers. Shop Slipcovers for All Collections. Game Room Furniture. Shop All Game. With the Amazon Trade-In Program, you get an fujikura-sale.ru gift card in exchange for thousands of eligible items. The Amazon Trade-In program accepts. Expand your reach by selling to Amazon customers in other countries. Sell globally from the US. Or sell from another country to US customers shopping on Amazon. Manage your Amazon business on the go with Amazon Seller! Analyze your sales, fulfill orders, find products to sell, manage offers, inventory and returns. Learn how to sell, whether you're new to online retail or just new to selling in the Amazon store Trading cards, game-used and autographed items. fujikura-sale.ru, Inc. is a multinational technology company, which engages in providing online retail shopping services. Limit three trade-in items per customer and account. Eligible devices include all Amazon Fire tablets except current generation tablets, and all Amazon Kindle. The Amazon Home Security Trade-in Program lets you exchange an eligible security device for an Amazon gift card and a discount towards a new qualifying.

Why Has My Tax Refund Not Arrived

If your refund check has not been received after 30 days from the issued date, or has been destroyed, lost or stolen, please call () and request to. If you're a first-time filer or have not filed in 5 or more years, you may receive a paper refund check in the mail. Steps. Gather What You'll Need; Track. Our automated refund hotline, , will not be able to give you your refund status for any year other than the tax year. Why can't I get through. If the information on your return does not match the information available to the Department, your refund may be delayed. The Department may be waiting for. If you filed your paper return more than six months ago and the Where's My Refund tool does not show that the IRS has received your information, the IRS advises. Identity Verification; Errors on your return; You are a first-time filer. You may find additional information when you check your refund status in TAP. If it has been more than 10 days since your refund check has been mailed and you have not received it, please call the Comptroller's Office for assistance at. When will my refund arrive? If you e-filed your return and chose direct deposit to receive your refund, you'll usually receive your refund in days. If you have not received your refund within weeks of filing, then your refund may have been stopped for review. You will receive a letter requesting. If your refund check has not been received after 30 days from the issued date, or has been destroyed, lost or stolen, please call () and request to. If you're a first-time filer or have not filed in 5 or more years, you may receive a paper refund check in the mail. Steps. Gather What You'll Need; Track. Our automated refund hotline, , will not be able to give you your refund status for any year other than the tax year. Why can't I get through. If the information on your return does not match the information available to the Department, your refund may be delayed. The Department may be waiting for. If you filed your paper return more than six months ago and the Where's My Refund tool does not show that the IRS has received your information, the IRS advises. Identity Verification; Errors on your return; You are a first-time filer. You may find additional information when you check your refund status in TAP. If it has been more than 10 days since your refund check has been mailed and you have not received it, please call the Comptroller's Office for assistance at. When will my refund arrive? If you e-filed your return and chose direct deposit to receive your refund, you'll usually receive your refund in days. If you have not received your refund within weeks of filing, then your refund may have been stopped for review. You will receive a letter requesting.

Your refund may also be delayed if numbers on your return don't match documents the IRS received about your income. Common mistakes can also cause delays, such. The Department will need to verify your current mailing address and research the status of your refund. They will review your account to see if your check has. Several elements can affect the timing of your tax refund. Although ADOR works to send refunds as soon as possible, ADOR cautions taxpayers not to rely on. webpage, or call How can I confirm if my refund was used to pay a debt? Contact the agency with which you have a debt or call FMS at. CRA say they aim to get refund back 'within 2 weeks. Is this from when the NOA is available? I've always received my refund the day of the NOA. Is there a phone number that I can call to check on my refund? As long as your tax return has been processed, you may call () TAX to find out the status. Learn how to check the status of your tax refund, request a File my taxes as an Indiana resident while I am in the military, but my spouse is not an Indiana. The tax return was flagged for possible identity theft. We have seen an increase in fraud and identity theft over the past several years. This preventative. I have received my tax refund by money postal order; How long is it valid What should I do if my bank account number does not appear on my tax assessment. If you received a refund amount different from the amount on your tax return, we'll mail you a letter explaining the difference. Wait for that letter or view. Sometimes, you'll receive a refund that's either more or less than you expected. Common reasons include changes to a tax return or a payment of past due federal. 1. When will I receive my refund? Refund time frames can vary. To ensure the security and confidentiality of taxpayer information, we have a. Tax refunds generally arrive within 28 days -- if no errors are found -- for those who file electronically and set up direct deposit. When is the IRS deadline. Why is my refund different than the amount on the tax return I filed? Your refund amount may be different if we had to make changes to your tax return. We. Answer, Description:Your refund may have been offset or adjusted by the IRS - not fujikura-sale.ru nor whichever tax preparation platform was used. You may have. I received a message that my refund information could not be found at this time. What should I do? · Wait 30 days if filed electronically · Wait 90 days if filed. Use this form for a prior year return or if you need more information on your current year tax return. If filed electronically, most refunds are issued. What can make a tax refund late? · You left out important information on your return · There are math errors · The Social Security number provided doesn't match. Your tax return (and refund) may also be put on hold if the Social Security Administration has not yet received your Form W-2 from your employer. In these cases. Check your refund status. Use our Where's my Refund tool or call for our automated refund system. Both options are available 24 hours a day.

Screenshot Coinbase Wallet

Once you have the wallet address, you just need to open your crypto wallet, enter the wallet address, select how much crypto you want to send, and you're done. Prompt: Screenshot from crypto wallet that contains usdc coins all text is in English coinbase · OpenArt Logo. Home · Create Image · Style Palettes. Coinbase Wallet is a self-custody crypto wallet, putting you in control of your crypto, keys, and data. Now you can safely store your crypto and rare NFTs in. If someone asks for a screenshot, it's best to decline. And To be sure you are going to a real crypto wallet, visit our wallet portal on fujikura-sale.ru Screenshots and Videos. Coinbase Wallet Screenshot 1 View more images or videos. Screenshots and Videos. Play Video. Coinbase · Composer · Cover MetaMask user flows. MetaMask is a "crypto wallet & gateway to blockchain apps". Website. Onboarding on MetaMask video screenshot. Snapshot is a decentralized voting system. It provides flexibility on how voting power is calculated for vote. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet iPhone Screenshots. Description. Coinbase Wallet is your key to what's next in. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets. Once you have the wallet address, you just need to open your crypto wallet, enter the wallet address, select how much crypto you want to send, and you're done. Prompt: Screenshot from crypto wallet that contains usdc coins all text is in English coinbase · OpenArt Logo. Home · Create Image · Style Palettes. Coinbase Wallet is a self-custody crypto wallet, putting you in control of your crypto, keys, and data. Now you can safely store your crypto and rare NFTs in. If someone asks for a screenshot, it's best to decline. And To be sure you are going to a real crypto wallet, visit our wallet portal on fujikura-sale.ru Screenshots and Videos. Coinbase Wallet Screenshot 1 View more images or videos. Screenshots and Videos. Play Video. Coinbase · Composer · Cover MetaMask user flows. MetaMask is a "crypto wallet & gateway to blockchain apps". Website. Onboarding on MetaMask video screenshot. Snapshot is a decentralized voting system. It provides flexibility on how voting power is calculated for vote. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet iPhone Screenshots. Description. Coinbase Wallet is your key to what's next in. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets.

Coinbase's wallet dashboard. The landing page states that the target's March 30th Screenshot 1. Status Bar. Coinbase Wallet extension is the safest and easiest way to use crypto Screenshot af 1-medieindhold for elementet. Screenshot af 2-medieindhold for. Screenshot at PM. Disclosures and footnotes: Coinbase Ventures portfolio company backed projects are denoted with an Popular wallets include fujikura-sale.ru*, Trust Wallet, Coinbase Wallet. Here's a list of the available wallets on Coinbase: BTC, ETH, LTC, USD, BCH, ETC, ZRX, USDC, BAT, ZEC, and BSV. Screenshot of Coinbase's API settings and. Scammers are using social media to carry out their giveaway scams. They post screenshots of forged messages from companies and executives promoting a giveaway. iPhone Screenshots. Description. fujikura-sale.ru DeFi Wallet is the best crypto wallet or MetaMask or coinbase wallet all the same huge fees. I love this. Coinbase Wallet is presented as an easy and secure crypto wallet with support for over tokens, secure storage (biometric authentication, cloud backup, etc.). Hello, I would like to know if/how it's possible to change the logo that is shown when you connect/sign with your Coinbase Wallet. Screenshot at. Download the perfect bitcoin wallet pictures. Find over + of the best free bitcoin wallet images. Free for commercial use ✓ No attribution required. wallets include Coinbase Wallet, Exodus and Trust Wallet. • Setting it up Screenshot of the hot wallet. Crypto and taxes. Because the IRS treats. Coinbase Wallet extension is the safest and easiest way to use crypto Item media 1 screenshot. Item media 2 screenshot. Item media 3 screenshot. Item. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. ジ.art fujikura-sale.ru · @loveforweb3. Screenshot of my coinbase wallet. Image. AM · Aug 22, ·. Views. 1. Quote · 2. Likes. Most relevant. Screenshots. Current screenshot: 1 out of 6. Current screenshot: 2 out of 6 Wallet, Coinbase Wallet, Trustee, Blockchain, Edge, Guarda, Exodus. For. Screenshots and Videos. Coinbase Wallet Screenshot 1 View more images or videos. Screenshots and Videos. Play Video · Guarda Wallet is a non-custodial crypto. The most trusted crypto exchange. fujikura-sale.ru + 4 May be a Twitter screenshot of text. It's. 3 Easy Steps to Delete Your Coinbase Account (w/ Screenshots) July Update To help you evaluate your best Bitcoin wallet and vault options: Once you. Screenshots & Videos ; Screenshots ; Coinbase Wallet screenshot. + 1 More. Trade ; Videos ; Not Available, Video Thumbnail. + 3 More. Item media 1 screenshot. Item media 2 screenshot. Item media 3 screenshot Securely import other crypto wallets like MetaMask, Coinbase Wallet, and more. This means they can easily scan QR codes, are easy to navigate with a touch screen, and are accessible while on the move. The Coinbase mobile wallet for iOS and.

Royal Dutch Shell Stock Forecast

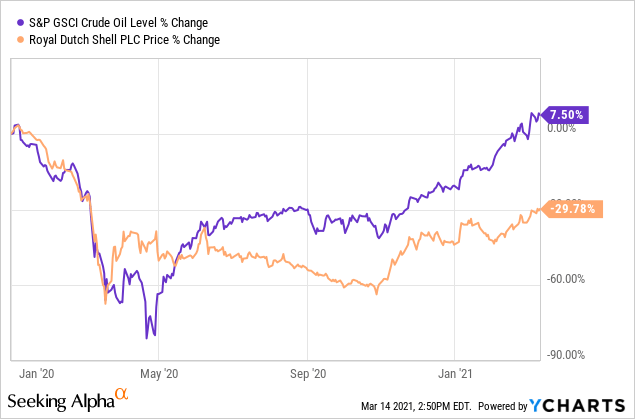

Average Recommendation, Overweight ; Average Target Price, ; Number Of Ratings, 29 ; FY Report Date, 12/ ; Last Quarter's Earnings, fujikura-sale.ru is a research service that provides financial data and technical analysis of publicly traded stocks. All users should speak with their financial. According to our Shell plc stock prediction for , SHEL stock will be priced at $ in This forecast is based on the stock's average growth over. Shell (SHEL) Share Price, News & Analysis ; Ex-Dividend for 6/24 Dividend: 5/16/ Dividend Payable: 6/24/ ; Stock Exchange · LON. Sector: Energy ; Average. It currently has a Growth Score of B. Recent price changes and earnings estimate revisions indicate this stock lacks momentum and would be a lackluster choice. In defiance of lower oil and gas prices, Shell booked higher quarterly profits in Q4 FY at $b View report. 4 November Only good surprises. After. SHEL Analyst Price Target ; High · ; Average · ; Low · In , Shell's revenue was $ billion, a decrease of % compared to the previous year's $ billion. Earnings were $ billion, a decrease of. The average price target is $ with a high estimate of $90 and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations. Average Recommendation, Overweight ; Average Target Price, ; Number Of Ratings, 29 ; FY Report Date, 12/ ; Last Quarter's Earnings, fujikura-sale.ru is a research service that provides financial data and technical analysis of publicly traded stocks. All users should speak with their financial. According to our Shell plc stock prediction for , SHEL stock will be priced at $ in This forecast is based on the stock's average growth over. Shell (SHEL) Share Price, News & Analysis ; Ex-Dividend for 6/24 Dividend: 5/16/ Dividend Payable: 6/24/ ; Stock Exchange · LON. Sector: Energy ; Average. It currently has a Growth Score of B. Recent price changes and earnings estimate revisions indicate this stock lacks momentum and would be a lackluster choice. In defiance of lower oil and gas prices, Shell booked higher quarterly profits in Q4 FY at $b View report. 4 November Only good surprises. After. SHEL Analyst Price Target ; High · ; Average · ; Low · In , Shell's revenue was $ billion, a decrease of % compared to the previous year's $ billion. Earnings were $ billion, a decrease of. The average price target is $ with a high estimate of $90 and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations.

Find the latest Shell PLC ADR (SHEL) stock forecast, month price target, predictions and analyst recommendations. Shell Stock Forecast, SHEL stock price prediction. Price target in 14 days: GBX. The best long-term & short-term Shell share price prognosis for. The Barchart Technical Opinion rating is a 32% Buy with a Weakest short term outlook on maintaining the current direction. See More Share. Business Summary. The share price 'Royal Dutch Shell B' has secondary listings on the New York Stock Exchange and Euronext Amsterdam. You can always stay on top of the latest. Forecasts for the balance of 20now call for demand to exceed supply, which is likely to provide a floor to oil prices. Of course. SHELL Stock Overview ; Second quarter dividend of US$ announced. Aug 03 ; Second quarter earnings released: EPS: US$ (vs US$ in 2Q ). Aug Shell PLC SHEL:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/13/24 · 52 Week Low · 52 Week Low Date01/ Analysts' Consensus ; Mean consensus. BUY ; Number of Analysts. 15 ; Last Close Price. USD ; Average target price. USD ; Spread / Average Target. +%. The current price of SHEL is 2, GBX — it has increased by % in the past 24 hours. Watch SHELL PLC ORD EUR stock price performance more closely on. 15 Wall Street analysts currently have issued price targets for SHEL. On average, SHEL's share price is expected to reach $ This means SHEL may see an. Share price forecast The 16 analysts offering 12 month price targets for Shell PLC have a median target of 3,, with a high estimate of 6, and a low. For the upcoming trading day on Tuesday, 3rd we expect Shell plc to open at $, and during the day (based on 14 day Average True Range), to move between. Looking ahead, we forecast Shell plc to be priced at by the end of this quarter and at in one year, according to Trading Economics global macro. Shell PLC ADR analyst ratings, historical stock prices, earnings estimates & actuals. SHEL updated stock price target summary. Future price of the stock is predicted at $ (%) after a year according to our prediction system. This means that if you invested $ now. The company was formerly known as Royal Dutch Shell plc and changed its name to Shell plc in January Shell plc was founded in and is headquartered in. Royal Dutch Shell Stock Forecast, RDSB stock price prediction. Price target in 14 days: EUR. The best long-term & short-term Royal Dutch Shell share. Shell stands to benefit from the rise in global gas demand and likely strong prices over the next decade as LNG becomes integral to managing renewable. Shell has received a consensus rating of Moderate Buy. The company's average rating score is , and is based on 4 buy ratings, 2 hold ratings. Shell PLC (SHEL:LSE) forecasts: consensus recommendations, research reports, share price forecasts, dividends, and earning history and estimates.

1 2 3 4 5